These rates are effective from 1st July 2016. Short title and application.

Your Step By Step Correct Guide To Calculating Overtime Pay

RM50 8 hours RM625.

. Territory Monthly Hourly Daily Number of days worked in a week 6 5 4 Sabah Sarawak and Labuan RM 920 RM 442 RM 3538 RM 4246 RM 5308 Note. 60B of Malaysia Employment Act 1955. Which gives the Director General the power to inquire into and decide any dispute between an employee and his employer in respect of any matter relating to discrimination in employment and make an order.

The Bill seeks to introduce a new Section 69F. From 1 September 2022 when the new Employment Act EA amendments come into force See. K Das J in Hariprasad v Divelkar AIR 1957 SC 121.

Ordinary Rate Monthly Salary 26. Some employers may call it downsizing rightsizing reorganizing. The discharge of surplus labour or staff by the employer for any reasons whatsoever otherwise than as a punishment inflicted by way of disciplinary action.

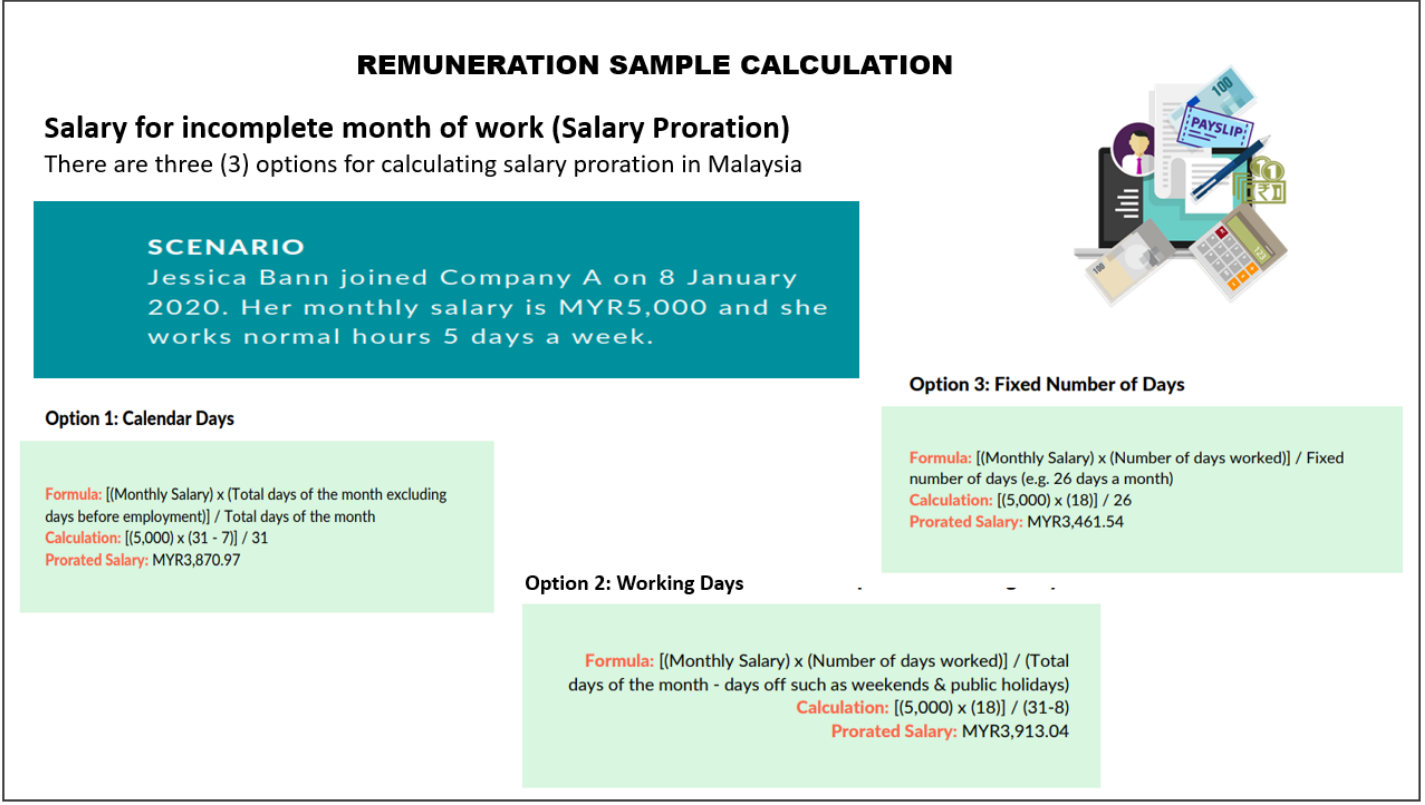

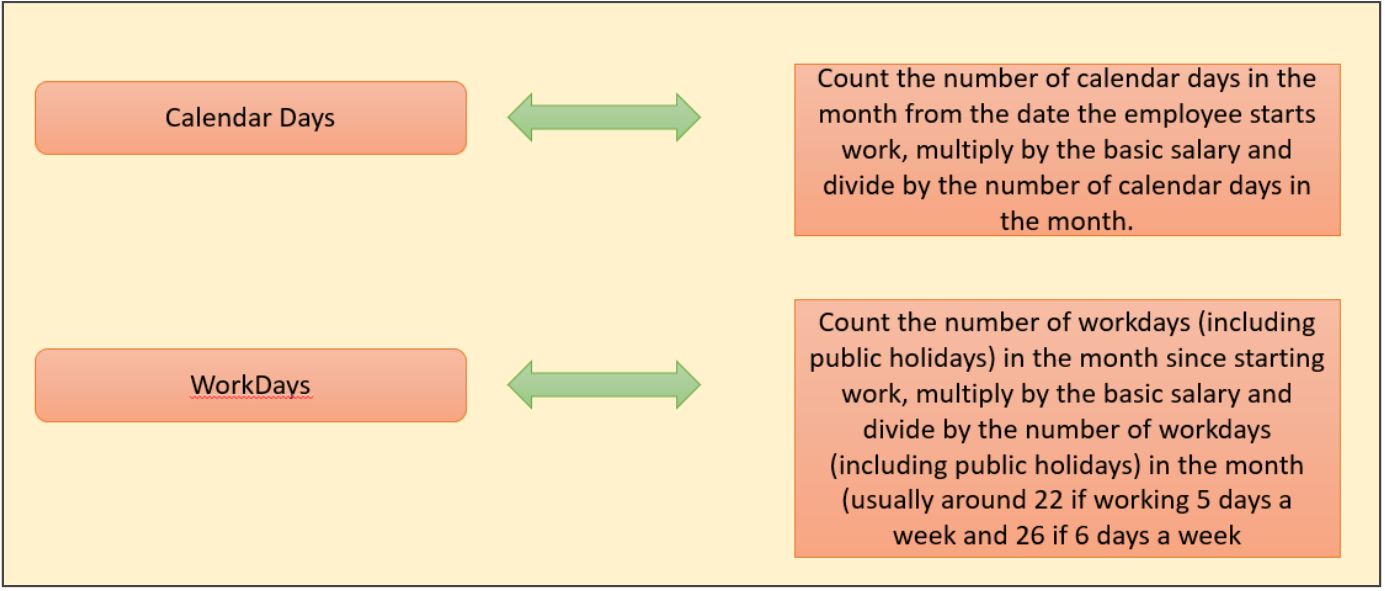

Ali earned RM 2000 a month and took 4 days of unpaid leave in September 2020. Find the number of working days in the current month. Use this number to calculate how much the employee is paid daily monthly salaryworking days in a month.

Payment for termination notice. RM 5500x 12 calculation by percentage EPF Employee Contribution. Multiply this number by the total days of unpaid leave.

In this article we will study the laws governing the hours of work and overtime work for employees under Malaysias labour laws. Less than 2 years. RM 3000 RM 2500 RM 5500 EPF Employer contribution.

PART I - PRELIMINARY. Here this would be RM625 x 15 x 2 hours RM1875 ii Rest days. Hourly Pay Daily Rate of Pay Normal Working Hours.

Paying employee wages late According to the Employment Act 1955 employers are required to payout monthly wages on the seventh day of the following month or earlier. Now we calculate their salary by dividing 30days paid salary6000- 600030 30-216000-20096000-18004200 Now dividing by 26 days paid salary6000- 600026 26-176000-2307696000-20773923 I think 42003929 off-course this is beneficial for employee. For work on a rest day the pay shall be no less than 20 times the hourly rate and on a public holiday no less than 30 times the hourly rate.

The specific amount of work to be performed and not by the day or by the piece. If an employee is required to work overtime on a normal working day heshe must be paid 15 times the hourly wage rate. Under Employment Act 1955 each employer must pay employee at least once a month.

Salary with fixed allowances X 12 months X years of services divided by 365 days. RM 1600 26 RM 61. 2what formula to use to calculate monthly salary.

RM 5500x 12 Calculation by percentage EPF Staff contribution. Non-compliance by an employer with such an order would be an offence. Then calculate the overtime pay rate by multiplying the hourly rate by 15 and then multiply that figure with the number of overtime hours worked.

Working period of more than 5 years 20 days of salary per year. ID For the purposes of payment of sick leave under section 60F the calculation of the ordinary rate of pay of an employee employed on a daily rate of pay or on piece rates under subsection 1C. This is as per S.

However the Act only covers a number of select employee categories in Malaysia. If the employees salary does not exceed RM2000 a month or falls within the First Schedule of Employment Act 1955 then we will refer to the Employment Act 1955. RM 3000 RM 2500 RM 5500 EPF Employer Contribution.

RM 5500x 12 calculation by percentage. How much should be deducted. Working hours in Malaysia.

RM 5500 x 11 refer Third Schedule. Divide the employees daily salary by the number of normal working hours per day. Employees who earn monthly wages of RM2000 or less.

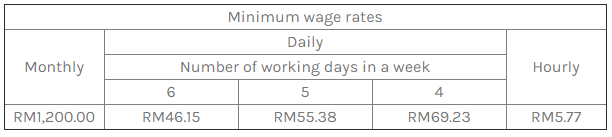

The regular working hours in Malaysia are eight hours a day and 48 hours a week. Each employee salary must be paid as follows. Minimum Wage in Malaysia The following table outlines the minimum wages in Malaysia as per the guidelines on the implementation of the Minimum Wages Order 2016.

Example of Malaysia Overtime Calculation. RM 6000 RM 2500 RM 8500. RM 5500 x 11 see Third Annex Payment of overtime on public holidays is paid at a rate of 30000 of the regular wage rate.

Working period of 1- 2 years 10 days salary per year. An employer and employee may agree that the wages of the employee shall be paid at an agreed rate in accordance with the task ie. Working period of 2- 5 years 15 days salary per year.

The Labor Law in Malaysia is regulated mainly by the Employment Act of 1955. To calculate the daily rate you can divide the monthly salary by. Other rates for overtime work are as follows.

Employment Act to apply to all employees from 1 September 2022 some sections subject to increased salary threshold of RM4000month all employees with wages up to RM4000month will be entitled to overtime paymentsThis is a significant change from the pre. Payroll Cycle Calculation in Malaysia A payroll had to be made to the employee. Within 7 days after the end of salary period For overtime work within 14 days after the end of the salary period.

The Malaysia retrenchment benefits for EA-eligible employees are as follows. How to Perform Salary Calculator Malaysia. RM 76 x 10 x 15 RM 114.

Overtime Pay Hourly Rate X Overtime Hours X 15. Thanks Manish 14th July 2011 From India Bangalore MadhuTK 3742 6. RM 615 8 RM 76.

If the employees salary exceeded RM2000 a. As per Employment Act 1955 Malaysia the employee shall be paid at a rate not less than 15 times hisher hourly rate for overtime work in excess of the normal work hours.

Malaysia S New Minimum Wage To Take Effect From 1 May 2022 What Employers Should Note

Service Contract Offer Letter How To Draft A Service Contract Offer Letter Download This Service Contract Offer Lettering Download Letter Example Templates

Your Step By Step Correct Guide To Calculating Overtime Pay

Salary Formula Calculate Salary Calculator Excel Template

Salary Formula Calculate Salary Calculator Excel Template

Everything You Need To Know About Running Payroll In Malaysia

Your Step By Step Correct Guide To Calculating Overtime Pay

Salary Formula Calculate Salary Calculator Excel Template

Formul St Partners Plt Chartered Accountants Malaysia Facebook

Salary Formula Calculate Salary Calculator Excel Template

Revised 2022 Salary Increase Budgets Head Toward 4

Salary Calculation Dna Hr Capital Sdn Bhd

Employment Law New Minimum Wage Rates To Take Effect On 1 February 2020 Lexology

Your Step By Step Correct Guide To Calculating Overtime Pay

How To Calculate Overtime Pay For Employees In Malaysia Althr Blog

Your Step By Step Correct Guide To Calculating Overtime Pay

Everything You Need To Know About Running Payroll In Malaysia

How To Calculate Overtime Pay From For Salary Employees Youtube

Your Step By Step Correct Guide To Calculating Overtime Pay